The Future of Offshore Investment and Exactly How It's Progressing in the Global Market

The Future of Offshore Investment and Exactly How It's Progressing in the Global Market

Blog Article

Just How Offshore Investment Functions: A Step-by-Step Break Down for Financiers

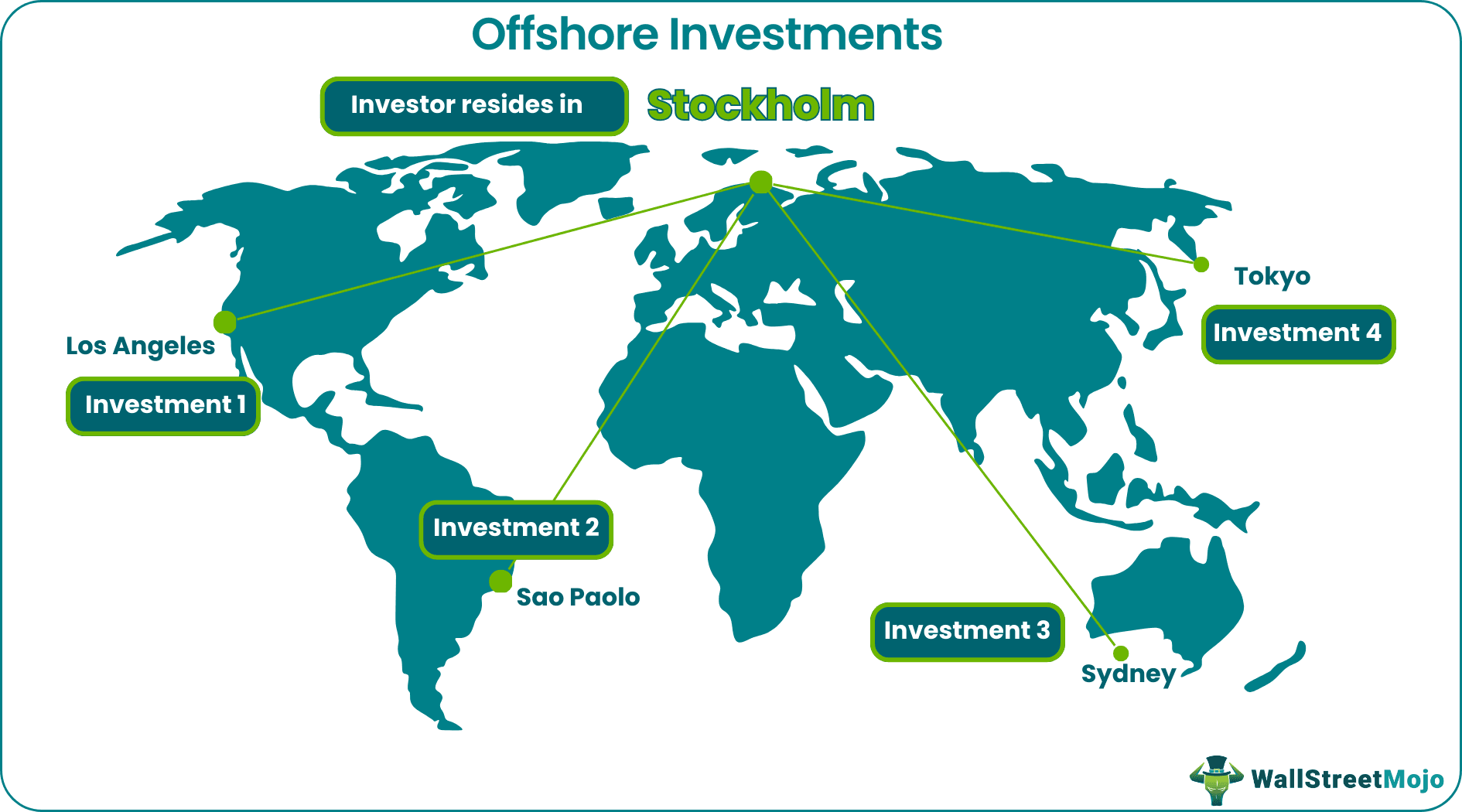

Offshore financial investment offers a structured path for capitalists looking for to optimize their monetary approaches while leveraging worldwide possibilities - Offshore Investment. The procedure starts with the careful choice of a territory that straightens with a capitalist's goals, followed by the establishment of an account with a credible overseas establishment. This systematic approach not only enables for profile diversity yet also requires recurring monitoring to browse the complexities of international markets. As we explore each action in detail, it ends up being obvious that recognizing the nuances of this investment technique is essential for achieving optimum end results.

Comprehending Offshore Financial Investment

Understanding overseas financial investment involves acknowledging the calculated benefits it uses to individuals and corporations seeking to enhance their economic portfolios. Offshore financial investments usually refer to properties held in an international jurisdiction, commonly identified by desirable tax regimes, regulative environments, and privacy protections. The key intention behind such investments is to enhance funding diversification, development, and threat management.

Capitalists can access a large range of economic tools with overseas locations, including supplies, bonds, common funds, and genuine estate. These financial investments are frequently structured to abide by regional legislations while offering flexibility in terms of possession allocation. In addition, overseas financial investment methods can allow organizations and people to hedge against residential market volatility and geopolitical dangers.

Another trick aspect of offshore financial investment is the possibility for enhanced personal privacy. Several overseas territories have rigorous confidentiality regulations, which can secure a financier's monetary information from public disclosure. Nevertheless, it is essential for investors to remain compliant with their home country's tax policies and reporting demands, as non-compliance can result in severe charges. An extensive understanding of both the advantages and commitments associated with offshore financial investments is important for informed decision-making.

Advantages of Offshore Spending

Financiers usually transform to offshore spending for its many advantages, consisting of tax performance, property security, and portfolio diversity. Among the key advantages is the capacity for tax obligation optimization. Many offshore territories supply favorable tax obligation regimes, permitting capitalists to lawfully decrease their tax obligation responsibilities and maximize returns on their investments.

Furthermore, overseas accounts can offer a layer of asset protection. Offshore Investment. By placing possessions in politically secure jurisdictions with solid personal privacy legislations, financiers can secure their wealth from potential legal claims, creditors, or economic instability in their home countries. This kind of security is particularly appealing to high-net-worth people and business owners facing lawsuits threats

Additionally, overseas investing promotes portfolio diversity. Accessing worldwide markets allows capitalists to explore possibilities in numerous property classes, consisting of realty, stocks, and bonds, which may not be available domestically. This diversification can reduce overall portfolio danger and boost potential returns.

Inevitably, the benefits of overseas investing are compelling for those looking for to enhance their economic approaches. However, it is critical for financiers to extensively understand the policies and ramifications related to offshore investments to make certain conformity and achieve their monetary objectives.

Picking the Right Jurisdiction

Choosing the suitable jurisdiction for offshore investing is a crucial choice that can considerably affect a financier's financial technique. The appropriate territory can offer numerous advantages, including favorable tax obligation structures, asset protection legislations, and governing atmospheres that align with an investor's goals.

When selecting a territory, take into consideration aspects such as the political stability and financial health of the country, as these aspects can impact financial investment security and returns. The lawful structure surrounding international investments ought to be examined to ensure compliance and security of properties. Countries known for robust lawful systems and transparency, like Singapore or Switzerland, usually instill why not check here better confidence amongst investors.

In addition, evaluate the tax obligation ramifications of the territory. Some countries offer appealing tax obligation incentives, while others may enforce strict coverage demands. Understanding these nuances can assist in optimizing tax obligations.

Steps to Establish Up an Offshore Account

Developing an overseas account involves a collection of systematic actions that make sure conformity and security. The initial step is selecting a respectable offshore financial institution, which need to be accredited and controlled in its territory. Conduct comprehensive research to evaluate the institution's reputation, solutions supplied, and customer reviews.

Next, collect the essential documents, which normally consists of recognition, proof of address, and information regarding the resource of funds. Various jurisdictions might have differing requirements, so it is vital to confirm what is required.

When the paperwork is prepared, initiate the application procedure. This may entail submitting types on-line or in person, depending on the organization's methods. Be gotten ready for a due persistance procedure where the financial institution will confirm your identity and analyze any kind of possible risks linked with your account.

After approval, you will receive your account details, allowing you to fund your offshore account. It is suggested to preserve clear documents of all transactions and abide with tax obligation laws in your home country. Developing the account correctly sets the foundation for efficient overseas financial investment management in the future.

Managing and Checking Your Investments

As soon as an offshore account is efficiently established, the focus moves to handling and monitoring your investments successfully. This crucial stage involves an organized method to ensure your properties align with your economic goals and run the risk of resistance.

Begin by developing a clear financial investment method that describes your purposes, whether they are prime preservation, income generation, or development. Routinely examine your profile's performance against these criteria to examine whether adjustments are needed. his explanation Utilizing monetary administration tools and platforms can facilitate real-time tracking of your financial investments, providing insights into market patterns and possession allotment.

Engaging with your overseas economic expert is vital. They can use know-how and assistance, aiding you browse intricate regulative atmospheres and global markets. Set up regular evaluations to discuss efficiency, examine market problems, and alter your strategy as required.

In addition, stay educated concerning geopolitical growths and economic indications that may affect your financial investments. This proactive strategy allows you to respond promptly to changing situations, guaranteeing your overseas portfolio stays robust and aligned with your investment objectives. Inevitably, thorough administration and ongoing monitoring are crucial for making the most of the benefits of your overseas financial investment strategy.

Final Thought

In verdict, offshore financial investment provides a calculated avenue for portfolio diversification and danger management. By picking an ideal jurisdiction and engaging with trustworthy banks, investors can navigate the intricacies of international markets successfully. The systematic approach described makes certain that financiers are well-equipped to optimize returns while sticking to lawful frameworks. Proceeded monitoring and cooperation with economic advisors continue to be vital for keeping an active investment strategy in an ever-evolving global landscape.

Offshore investment offers an organized pathway for capitalists seeking to optimize their monetary methods while leveraging worldwide chances.Comprehending overseas investment involves recognizing the strategic benefits it uses to individuals and companies looking for to maximize their economic profiles. Offshore investments normally refer to assets held in a foreign jurisdiction, frequently identified by positive tax obligation programs, governing settings, and privacy defenses. Additionally, offshore investment strategies can make it possible for individuals and businesses to hedge versus residential market volatility and geopolitical risks.

:max_bytes(150000):strip_icc()/offshore.asp-FINAL-1-941110e2e9984a8d966656fc521cdd61.png)

Report this page